new jersey 529 plan deduction

Also under the New Jersey College Affordability Act if you earn 75000 or less a year you may be eligible for up to 750 given as a matching grant for amounts you have. State tax deduction or credit for contributions.

New Jersey 529 College Savings Plans Help Parents Save For College

To get started you can deposit 25.

. Direct this New Jersey 529 plan can be purchased directly from the state. 4 rows New Jersey offers tax benefits and deductions when savings are put into your childs 529. New Jersey taxpayers with gross income of 200000 or less may qualify for a state income tax deduction for contributions into an.

The plan NJBEST is offered through Franklin Templeton. You must have a gross income of 200000 per. In New Mexico families can deduct 100 of their contributions to.

Many states provide an income tax deduction for contributing to a college savings plan including New York which provides a maximum annual 10000 deduction. When you take distributions any amounts that are used for higher education expenses as defined under section 529 of the Internal Revenue Code are excluded from. Now New Jersey taxpayers with gross income of 200000 or less can qualify for a state income tax deduction of up to 10000 per taxpayer for contributions to the plan.

Thanks to recent legislation however you may now be able to deduct up to 10000 of annual contributions you make to New Jerseys 529 plan the New Jersey Better. NJBEST New Jerseys 529 College Savings Plan is offered and administered by the New Jersey Higher Education Student Assistance Authority HESAA. As of January 2019 there are no tax deduction benefits when making a contribution to a 529.

New Jerseys plan doesnt offer much. New Jersey will offer a state tax deduction of up to 10000 per taxpayer per year for contributions to a New Jersey 529 plan. Managed and distributed by Franklin.

The Federal Tax Cuts and Jobs Act TCJA which was signed into law in December 2017 and became effective January 1 2018 expanded the definition of a qualified higher education. New Jersey does not provide any tax benefits for 529 contributions. State tax deduction or credit for contributions.

The proposed state budget includes a new state tax deduction for contributions of up to 10000 into an NJBEST account for families with incomes below 200000 state. The New Jersey College Affordability Act allows taxpayers with household adjusted gross income between 0 and 75000 may be eligible for a one-time grant of up to 750 matched dollar-for. New Jersey taxpayers with gross income of 200000 or less may qualify for a state income tax deduction for contributions into an.

N J S College Savings Plan Is One Of The Worst In The Nation It S About To Get Way Better State Says Nj Com

When Choosing Funds For Your College 529 Plan Don T Make This Mistake Kiplinger

529 Tax Benefits By State Invesco Invesco Us

Pre Tax Funding For College Education Under The Tax Cuts Jobs Act Clark Nuber Ps

Tax Deduction Rules For 529 Plans What Families Need To Know College Finance

New Jersey Nj 529 Plans Fees Investment Options Features Smartasset Com

How Much Should You Have In A 529 Plan By Age

529 Plan State Tax Deduction Limits And How To Choose A 529 Plan And Save Now For Future College Costs Prepaid Vs College Tax Savings Plan Aving To Invest

Can I Use A 529 Plan For K 12 Expenses Edchoice

Tax Benefits Nest Advisor 529 College Savings Plan

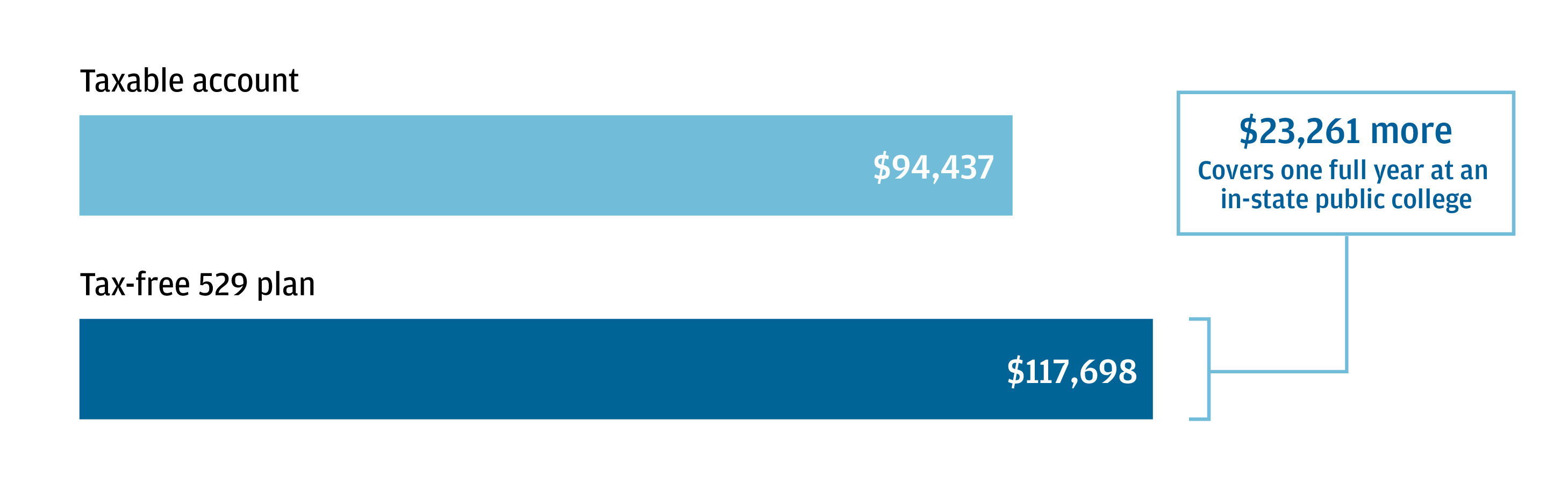

529 Plan Tax Benefits J P Morgan Asset Management

529 Plans Which States Reward College Savers Adviser Investments

How Much Are 529 Plans Tax Benefits Worth Morningstar

Nj 529 Plan Tax Deduction And Other Benefits For New Jersey Students

N J S 529 Plan Now Offers A Tax Break But Is It Enough Of An Incentive Nj Com

529 Tax Deductions By State 2022 Rules On Tax Benefits

5 Mistakes To Avoid When Saving For College In A 529 Plan Money

New Jersey Provides Tax Deduction For College Savings Plan Contributions